Global Trade, Customs, Logistics & Geopolitical Risk Update

Week 10 | Wednesday 04-03-2026

SEMUDMEX – Strategic Advisory in International Trade & Customs Compliance

1. U.S. Supreme Court Limits Tariff Authority

Source: Reuters / U.S. Court of International Trade reporting

Operational Explanation: Recent court rulings determined that tariffs imposed under the International Emergency Economic Powers Act exceeded executive authority. Potential refund exposure could reach USD 175 billion affecting more than 300,000 importers.

SEMUDMEX Practical Risk Assessment: Companies should analyze historical entries and evaluate refund, protest, or drawback opportunities.

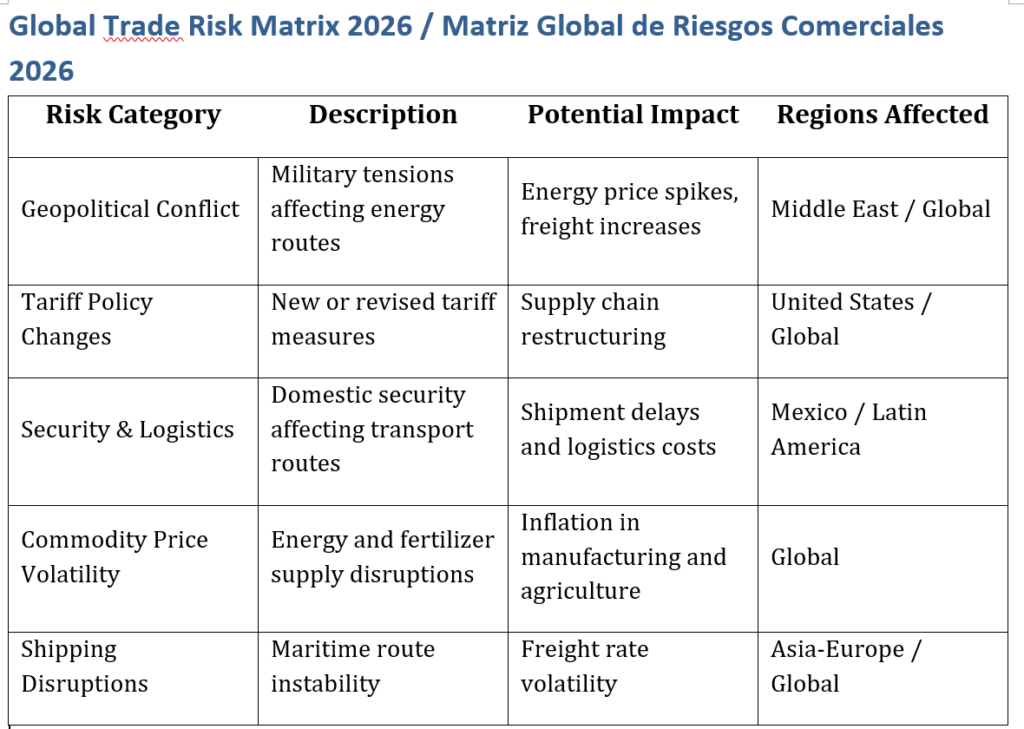

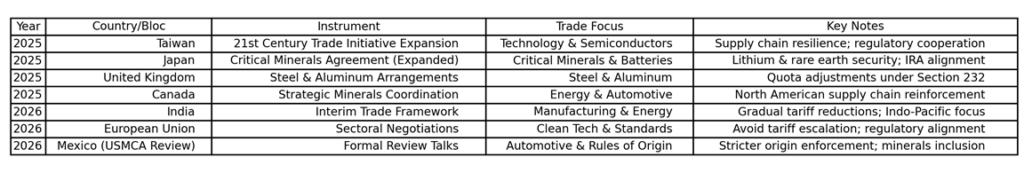

2. New U.S. Global Tariff Strategy Under Consideration

Source: Policy analysis and international trade reporting

Operational Explanation: Following the court decision, policymakers are evaluating alternative tariff frameworks including Section 232 and Section 301 authorities.

SEMUDMEX Practical Risk Assessment: Supply chains may face renewed tariff volatility affecting pricing, sourcing, and customs compliance.

3. CBP Electronic Refund Implementation (ACH)

Source: U.S. Federal Register / CBP guidance

Operational Explanation: Customs refunds are increasingly processed electronically via ACH payments, changing reconciliation processes for importers and brokers.

SEMUDMEX Practical Risk Assessment: Incorrect banking authorizations or broker coordination may delay refunds and create accounting issues.

4. CBP eBond Digital Validation

Source: CBP operational updates

Operational Explanation: Electronic bond transmission introduces stricter validation rules for import bonds guaranteeing duty payment.

SEMUDMEX Practical Risk Assessment: Bond sufficiency errors can block entries or delay cargo clearance.

5. Mexico RGCE 2026 – Digital Compliance Expansion

Source: SAT / Diario Oficial de la Federación

Operational Explanation: Mexico’s foreign trade rules reinforce documentation and electronic file consistency between invoices, transport documents and customs declarations.

SEMUDMEX Practical Risk Assessment: Inconsistent records increase the probability of shipment holds and post-clearance audits.

6. Security Events in Western Mexico Affect Nearshoring Logistics

Source: Mexican logistics and economic reporting

Operational Explanation: Security operations related to cartel leadership disruptions triggered temporary highway blockades in Jalisco, Michoacán and Guanajuato—key manufacturing corridors.

SEMUDMEX Practical Risk Assessment: These regions represent nearly 35% of Mexico’s automotive exports and major nearshoring investment zones.

7. Iran Conflict and Strait of Hormuz Shipping Risk

Source: Reuters maritime security briefings

Operational Explanation: Approximately 20% of global oil shipments pass through the Strait of Hormuz. Military tensions increased war-risk insurance premiums and slowed tanker traffic.

SEMUDMEX Practical Risk Assessment: Energy and freight costs may rise globally.

8. Global Fertilizer Supply Shock

Source: Financial Times commodities reporting

Operational Explanation: Fertilizer prices such as urea increased sharply due to geopolitical supply disruptions.

SEMUDMEX Practical Risk Assessment: Food supply chains and agricultural exports could experience cost volatility.

9. Maritime Freight Volatility

Source: Drewry and logistics market data

Operational Explanation: Container freight markets remain volatile due to capacity shifts and geopolitical disruptions in shipping lanes.

SEMUDMEX Practical Risk Assessment: Companies should anticipate fluctuating logistics costs in 2026.

10. Global Nearshoring Competition Intensifies

Source: international investment reports

Operational Explanation: Countries across Latin America and Southeast Asia are competing for manufacturing relocation from Asia.

SEMUDMEX Practical Risk Assessment: Mexico retains advantages due to USMCA access but security and infrastructure challenges remain key risk factors.