The landscape of nearshoring in Mexico is at a critical juncture, influenced by two momentous political events: the 2024 Mexican presidential elections and the 2024 U.S. presidential elections. The outcome of these elections could have a significant impact on Mexico’s attractiveness as a destination for the relocation of production operations.

A Complex Scenario of Variables:

Analyzing the future of nearshoring in Mexico involves understanding the complex interplay of variables emanating from both electoral processes.

On the one hand, the elections in Mexico will define the government’s direction in terms of public policies that directly impact nearshoring. A government favorable to foreign investment, modern infrastructure, and streamlined customs processes could generate a climate of stability and confidence, attracting companies interested in relocating.

On the other hand, the outcome of the U.S. elections will also play a fundamental role. A U.S. government that promotes free trade, regulatory collaboration, and reduced migration tensions could create a favorable environment for nearshoring in Mexico. However, an opposite scenario, with protectionist policies, increased migration tensions, or a weakened U.S. dollar, could generate uncertainty and discourage foreign investment.

Beyond the Election Results:

It is important to note that the future of nearshoring in Mexico is not solely dependent on the election results. The country’s competitiveness as a nearshoring destination will also be determined by factors such as:

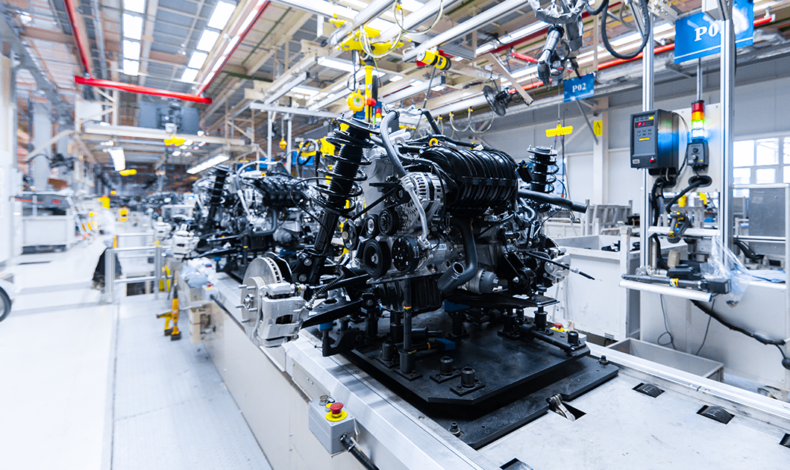

- Infrastructure quality: Efficient roads, ports, airports, and telecommunications networks are essential for the logistics and competitiveness of the manufacturing sector.

- Human capital: A qualified, adaptable workforce with the skills needed for the industries seeking to relocate is a key attraction factor.

- Regulatory framework: A transparent, predictable legal framework that facilitates investment and trade is essential to build investor confidence.

- Collaboration between the public and private sectors: Close collaboration between both sectors will be crucial to identify opportunities, design strategies, and overcome obstacles to the development of nearshoring.

Ultimately, the future of nearshoring in Mexico presents a complex and challenging landscape, but also one full of opportunities. The country’s ability to navigate uncertainty, strengthen its competitiveness, and seize the opportunities that arise from the political scenarios will be crucial to consolidate itself as an attractive destination for the relocation of production operations and economic growth.