In a significant turn of events, Mexico has once again emerged as the top trading partner of the United States, surpassing both Canada and China for the year. Trade between the U.S. and Mexico saw a notable 2.5% year-over-year surge, soaring to a staggering $798 billion in 2023. This surge was largely fueled by a remarkable increase in exports of gasoline and other fuels, alongside a surge in imports of passenger vehicles.

Meanwhile, bilateral trade between the U.S. and Canada experienced a slight dip, totaling $773.94 billion, marking a 2.37% decrease from the previous year. On the other hand, China ranked third, and witnessed a significant decline in trade by 16.73% year-over-year, amounting to $575.03 billion.

At the forefront of international trade gateways in the U.S. stood the port of entry in Laredo, Texas, boasting a remarkable total trade value of $320 billion. Remarkably, this marked the first time Laredo clinched the top spot as the nation’s premier trade port for the year.

Laredo’s dominance in cross-border commerce was primarily attributed to its robust trade with Mexico, which tallied an impressive $312 billion in 2023. China secured the second spot for trade through Laredo, although with a significantly lower figure of $1.8 billion.

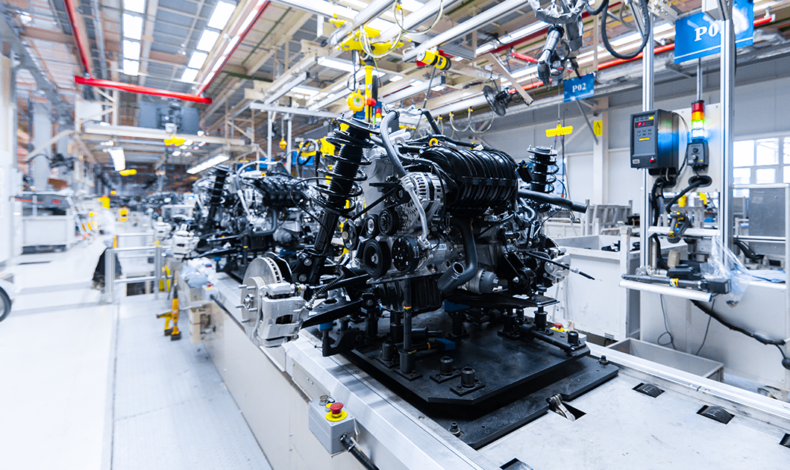

Experts attribute Mexico’s ascendancy in global trade to the burgeoning trend of nearshoring south of the border, particularly against the backdrop of strained U.S.-China trade relations. The expansion of Mexico’s manufacturing base has emerged as a compelling alternative to production in China, driving increased regional trade and nearshoring activities.

Despite Mexico’s triumphant position as the top U.S. trading partner for the majority of 2023, Canada managed to reclaim the throne in December, boasting trade totaling $61.1 billion. Mexico followed closely behind at $60.4 billion, with China rounding out the top three at $46.1 billion. Throughout the year, the port of entry in Laredo maintained its steadfast position as the premier international trade gateway in the U.S. December saw Laredo’s total commerce soar to $24.4 billion, reinforcing its pivotal role in facilitating trade between the U.S. and Mexico.

The cross-border trade between the U.S. and Mexico underscores the enduring significance of their economic relationship. With millions of cargo trucks crossing the border annually and key ports facilitating substantial trade flows, the symbiotic trade ties between the two nations continue to thrive and evolve.