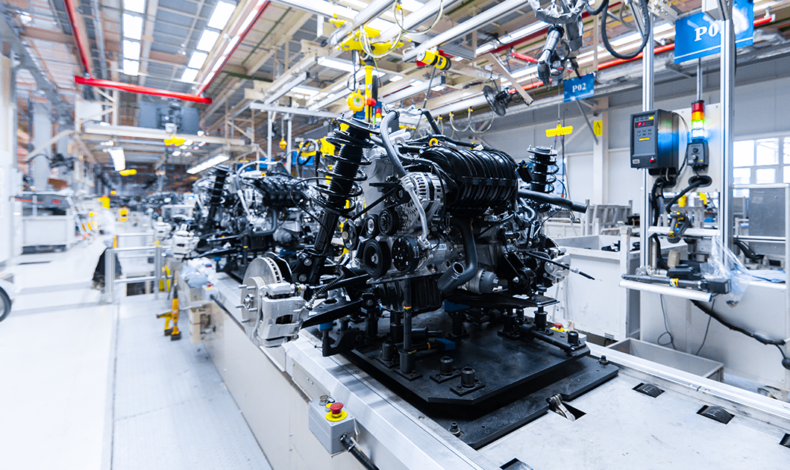

The relocation of investment flows, known as “nearshoring,” presents an opportunity for Mexico to boost investments in high-value-added technologies, ranging from cloud computing to artificial intelligence and Web3 solutions. However, to fully harness this potential, Mexico must strengthen its IP framework and create an innovation-friendly environment.

The Role of Intellectual Property:

IP plays a crucial role in the nearshoring process, as it provides legal protection for innovative technologies and know-how. A robust IP framework can attract foreign investment and encourage technology transfer, promoting the development of a local technology sector.

Mexico’s Potential:

Mexico is well-positioned to capitalize on the nearshoring trend due to its proximity to the United States, a strong manufacturing base, and a growing pool of skilled talent. However, to fully harness this potential, Mexico must strengthen its IP framework and create an innovation-friendly environment.

Recommendations for Mexico:

To consolidate an attractive innovation ecosystem for technology investors, Mexico should:

- Update its IP regulations: This includes modernizing copyright, patent, and trademark laws to align with international standards and best practices.

- Promote coordination among IP institutions: Strengthen collaboration between entities responsible for promoting and protecting IP rights to ensure efficient and effective enforcement.

- Foster dialogue between the public and private sectors: Establish regular channels of communication to discuss IP-related issues and challenges, and develop joint solutions that benefit all stakeholders.